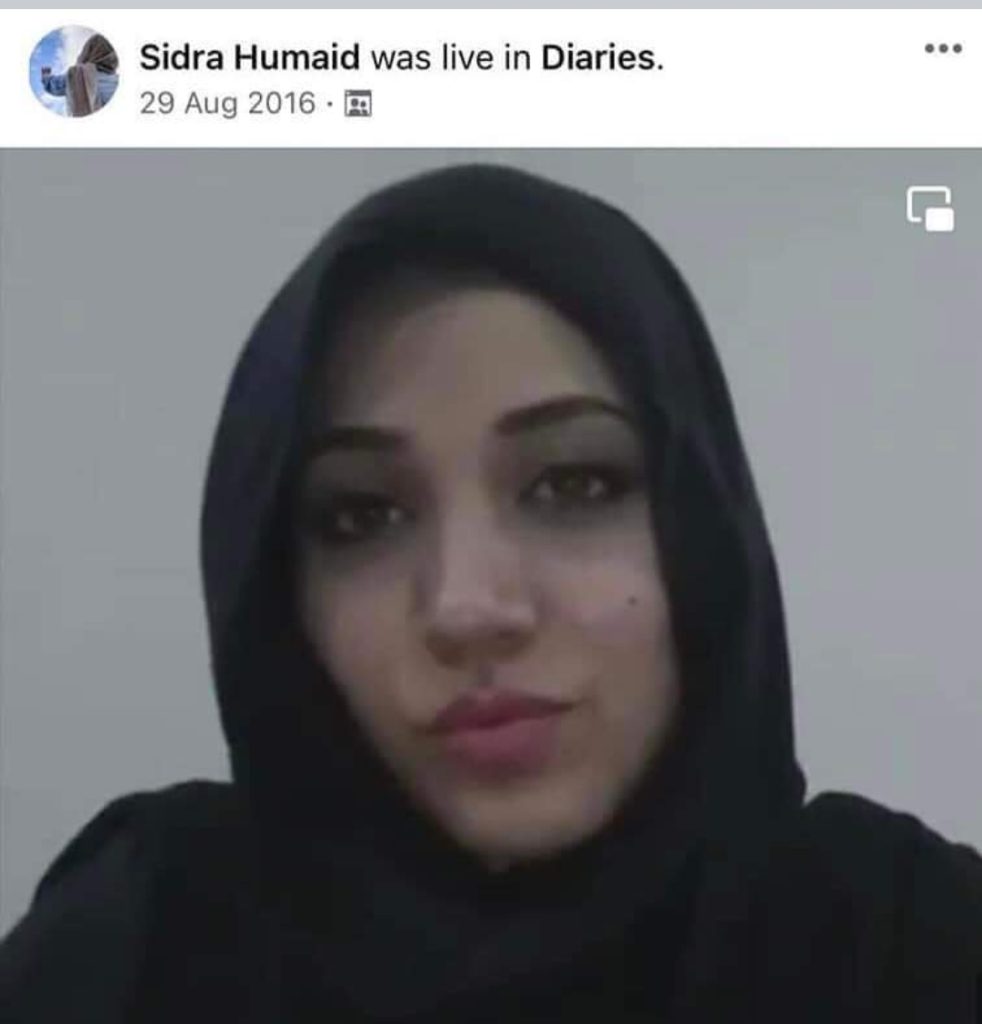

According to Geo News on Wednesday, Sidra Humaid, the perpetrator of one of the largest ballot committee (BC) scams who defrauded hundreds of trusting residents out of an estimated Rs. 420 million, has disappeared. Sidra is reportedly nowhere to be found because she isn’t at her assigned residence and is no longer reachable by phone.

The suspected “con-woman” claimed in a social media post that she was being pursued by criminals and had fled her home out of fear for her safety. According to a source, Sidra, the central figure in the committee scandal, referred to the people who lost their life savings in this swindle as violent criminals.

The insider continued, “She has also declared and filed for bankruptcy in a court of law. The affectees are calling and knocking on her door for recovery. In the meantime, the victims have filed a complaint with the Federal Investigation Agency (FIA) against this woman.

Sidra left her home quickly, so victims are worried that she won’t leave the country soon and have begged the FIA to act quickly before it’s too late. The government agency has great aspirations for the victims. Although the FIA has filed a preliminary report, the sources claimed that a formal complaint has not yet been made against the alleged con artist.

They continued by saying that, to strengthen their case before opening an investigation, the FIA has also requested information about all transfers and transactions made into and out of the suspect’s bank accounts.

Sidra also owns the home-based food businesses “Cróise” and “Daily Bites,” which specialize in handicrafts. Scams over the phone and online have become more prevalent over time. Every few days, the Federal Investigation Agency (FIA), the State Bank of Pakistan (SBP), the Securities and Exchange Commission of Pakistan (SECP), the Pakistan Telecommunication Authority (PTA), banks, etc. send out SMS and email alerts against phishing, phone, and online fraud. Nevertheless, occasionally, people become victims of scams.

Since 2015, the woman in issue had been running committees for her friends and family, commonly known as rotating savings and credit clubs. A sizable group of female business owners who operated diverse web ventures had placed an inordinate amount of trust in her. She reportedly managed 117 WhatsApp groups with hundreds of members to collect money, according to certain estimations made by her victims. Sidra allegedly received the first payment from the gathered funds in each group. A select number of people agree to pool together a predetermined sum each month for a predetermined period as part of the committee system.

Therefore, each group member is given a month from that period to collect Rs. 200,000 if a group of 10 members pools in Rs. 20,000 per month from January to October. With essentially no official paper trails other than when banking transactions are involved, the entire system is based on trust and word-of-mouth communication. The allegations of Sidra’s victims that she used the committee funds to roll over past dues for several months also hint at a Ponzi scheme.

Fraudster groom: Man marries 14 Women Posing as Govt Official, Dupes them of millions

Multi-level marketing, Ponzi, and pyramid schemes all urge new clients to bring in a certain number of additional members in a geometric progression, according to the central bank of Pakistan’s warnings. Only a few people at the top of the system get money after the membership process reaches a point of saturation and the entire organization collapses. Even though Sidra and her husband Humaid Ibrahim Farooqi are the only beneficiaries as of right now, some victims claim that given the size and scope of the fraud, there may be additional parties involved.

- Fake Pakistan Army Colonel Caught: Arrested for Extorting Millions of Rupees from Unsuspecting Citizens - 24/01/2024

- Unprecedented Milestone: Seven Players Make Test Cricket History by Returning to Pavilion with Zero Runs - 06/01/2024

- The brand new Ra Status Gamble Slots step three Lb Put Online totally free - 11/12/2023