Customers at various food establishments, both global and local, face uniform charges regardless of the payment method, be it digital transactions via credit/debit cards or cash.

A ProPakistani survey uncovered a surprising revelation that the electronic bills generated, incorporating a 5 percent sales tax for card payments and a 16 percent sales tax for cash transactions, are identical at certain food chain outlets. If a customer opts for cash payment, they are subjected to a 16 percent sales tax, while digital card payments incur a 5 percent sales tax. Nonetheless, the outlets employ a tactic of applying distinct base prices for cash and credit card transactions, ensuring that the final prices remain consistent with the payment of either a 5 percent or 16 percent sales tax.

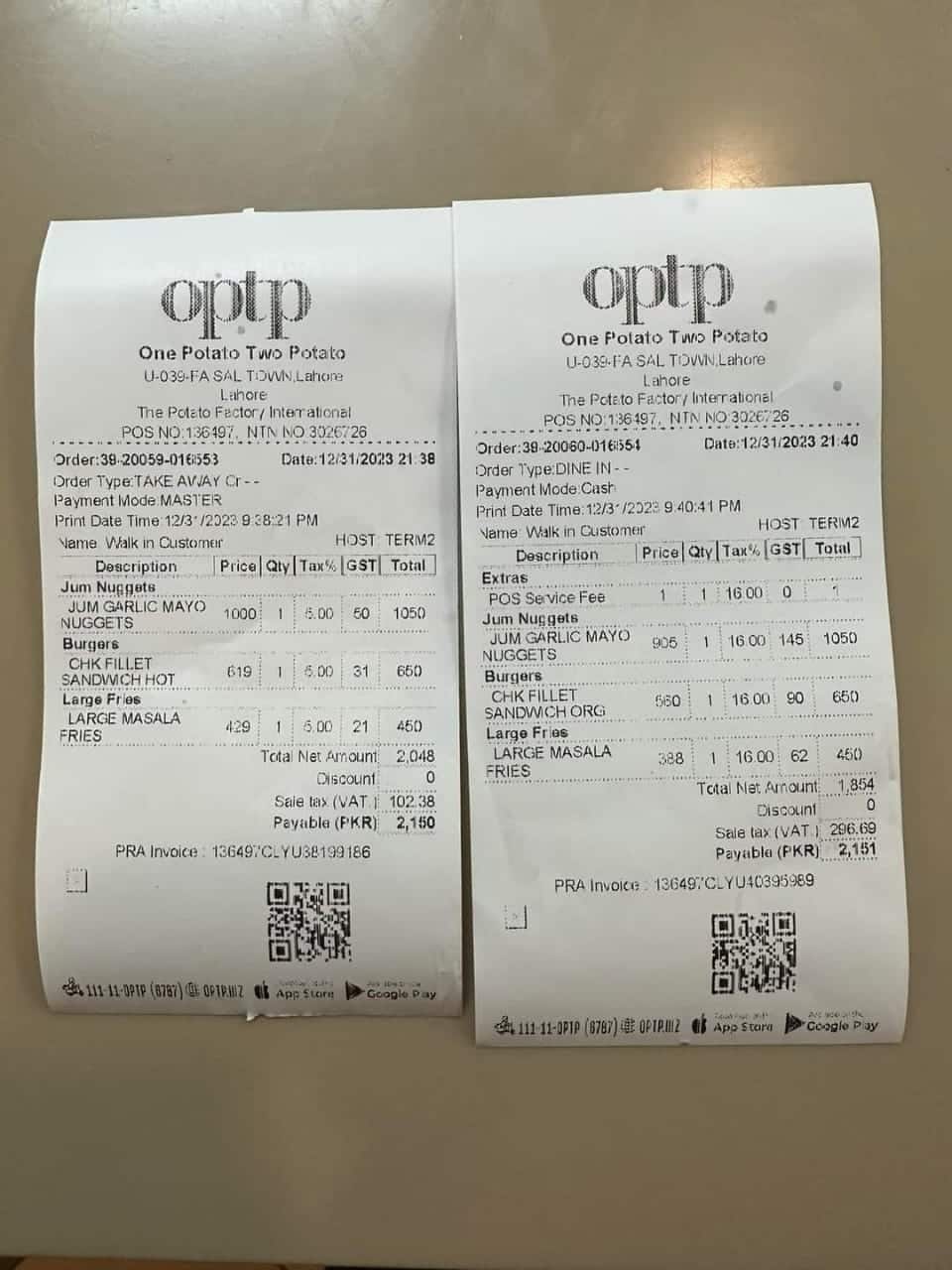

This strategy involves maintaining a uniform bottom price while adjusting the base prices for cash and credit card transactions. The fraudulent technique aims to gather equivalent amounts from customers, regardless of whether they pay a lower or higher rate of sales tax. Prices are artificially raised to ensure that customers using digital payment indirectly incur the higher 16 percent sales tax rate. In the case of OPTP, a comparison was conducted on receipts for an identical set of products from the same restaurant.

One receipt is for cash payment, with an expected 16% sales tax, while the other is for a digital payment order, with a supposed 5% tax rate. When customers choose card payment, the restaurant inflates the price by the tax rate difference, rather than passing on the intended savings to the consumer.

Despite an OPTP employee’s claim to ProPakistani that all base prices are fixed and the system generates receipts impartially, a comparison of identical bills (cash/card) suggests otherwise. Both receipts pertain to an identical collection of items and were issued mere minutes apart, as indicated by the timestamps. One receipt signifies a cash transaction, subject to a 16 percent sales tax, while the other corresponds to a digitally paid order (via card) with a 5 percent tax rate. It is noteworthy that the receipt on the left reveals the restaurant’s non-compliance with reporting card transactions to the Federal Board of Revenue (FBR). This suggests that when customers opt for card payments, the restaurant is increasing prices by the tax rate difference instead of passing on the anticipated savings to consumers.

It is apparent that the reduced sales tax on digital payments was initially introduced as a tax incentive and to promote a cashless economy. However, instead of benefiting consumers, certain restaurants are exploiting this opportunity to boost their profits. The regulatory authorities, particularly the FBR, should promptly address such establishments that maintain uniform prices for food products regardless of the payment method, taking decisive action to rectify this practice.

- Misleading Video Alters Prime Minister Shehbaz’s Speech Targeting Political Rival, Not His Party - 21/04/2024

- ATC Grants Three-Day Remand for Suspects in Ichhra Bazaar Harassment Case - 19/03/2024

- Pakistan, India, and Bangladesh Lead World in Severe Smog Crisis, Exceeding WHO Guidelines - 19/03/2024