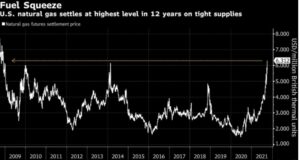

WASHINGTON – Constrained supply and booming demand are feeding on one another all over the world and thus natural gas prices jumped to 12 years high in the United States.

The prices skyrocketed in parts of the world mainly in Asian, European countries, as major consumers like China struggle to find sufficient supply fuel to meet demand in wake of the Covid-induced downturn that occurred quicker than expected.

Even in Europe, prices hiked more than 500 percent, while officials are expecting a haphazard situation in the upcoming winters.

Reports quoting officials said US natural gas prices recently closed at 12 years high of $6.31 per million British thermal units. In this week, implied volatility hiked to an all-time high of 122.5 percent, surpassing the 2018 record when the surge was recorded at 117.5 percent.

Experts reveal three key reasons behind skyrocketing gas prices:

Return to the workplace after plunge in Covid cases

As lockdowns end following the drop in covid Pandemic in the US, everyday life starts, in-person office routine has already started in many of the fields and factories are running which have contributed in the consumption of the fuel. US citizens are back on the road.

According to Federal Highway Administration, the number of vehicles plummeted in spring 2020, while the highway traffic was back up to what would normally be seen in midsummer in July.

Hurricane Ida clamped down oil production

Around 80 percent of US Gulf production remained offline last month, with many of the production platforms still unoccupied. Some reports said more than 17 million barrels of oil have been lost to the market.

Officials claimed that US crude oil production fall by 200,000 barrels bpd to 11.08 million bpd this year, a bigger decline than the forecast. The domestic oil supply crisis and stockpiles coupled with a rise in demand contributed to the surge.

Energy markets around the world are in a crunch

Amid the domestic crisis, international markets overseas aren’t helping in supply either. Top oil-exporting countries agreed to only a modest increase in production, despite oil consumers pushing for higher exports and lack of relief makes crude prices expensive.

Meanwhile, foreign oil cartels are equally responsible for crunch, despite increased domestic production. Other than natural gas, electricity prices have also hiked in recent times, while industrialists are looking for higher prices for the coming months.

Furthermore, global markets will have to wait by the end of this year to get more from the US when the sixth liquefaction train is expected to start producing LNG in test mode.

The crunch also alarmed US officials as Washington said ‘all tools in the toolbox’ are under consideration to combat high energy prices.

Ever Given, the ship that blocked Suez Canal, all set to release as legal dispute ends